Nottoway County Va Real Estate Assessments

Commissioner of Revenue

County Real Estate Taxes · Dog Tags · E911 Address · Landfill Invoices ... • Nottoway County, VA • 344 West Courthouse Road P.O. Box 92 Nottoway ...

https://nottoway.org/constitutional_officers/commissioner_of_revenue.phpWelcome to Nottoway County, Virginia

Treasurer's Department Treasurer: Tammie Raiford Email: [email protected] Mailing Address: P.O Box 85, Nottoway, VA 23955 Physical Address: 200 S. Main Street, Blackstone, VA 23824 Telephone: 434-645-9318 Fax: 434-645-8698 Office Hours: Monday- Friday 8:30 a.m. to 4:30 p.m. Payments: Pay by Mail: Make check or money order payable to: Nottoway County Treasurer, P.O.

https://nottoway.org/constitutional_officers/treasurer_s_department.php

Nottoway, VA Login

DISCLAIMER OF WARRANTIES: ALL FEATURES AND DATA ARE PROVIDED "AS IS" WITH NO WARRANTIES OF ANY KIND NOTTOWAY, VA AND INTERACTIVEGIS, INC. EXPRESSLY DISCLAIM ANY AND ALL WARRANTIES OF ANY TYPE, EXPRESS OR IMPLIED AND INCLUDING, BUT NOT LIMITED TO ANY WARRANTY REGARDING THE ACCURACY OF THE DATA, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE.

https://nottowaycova.interactivegis.com/

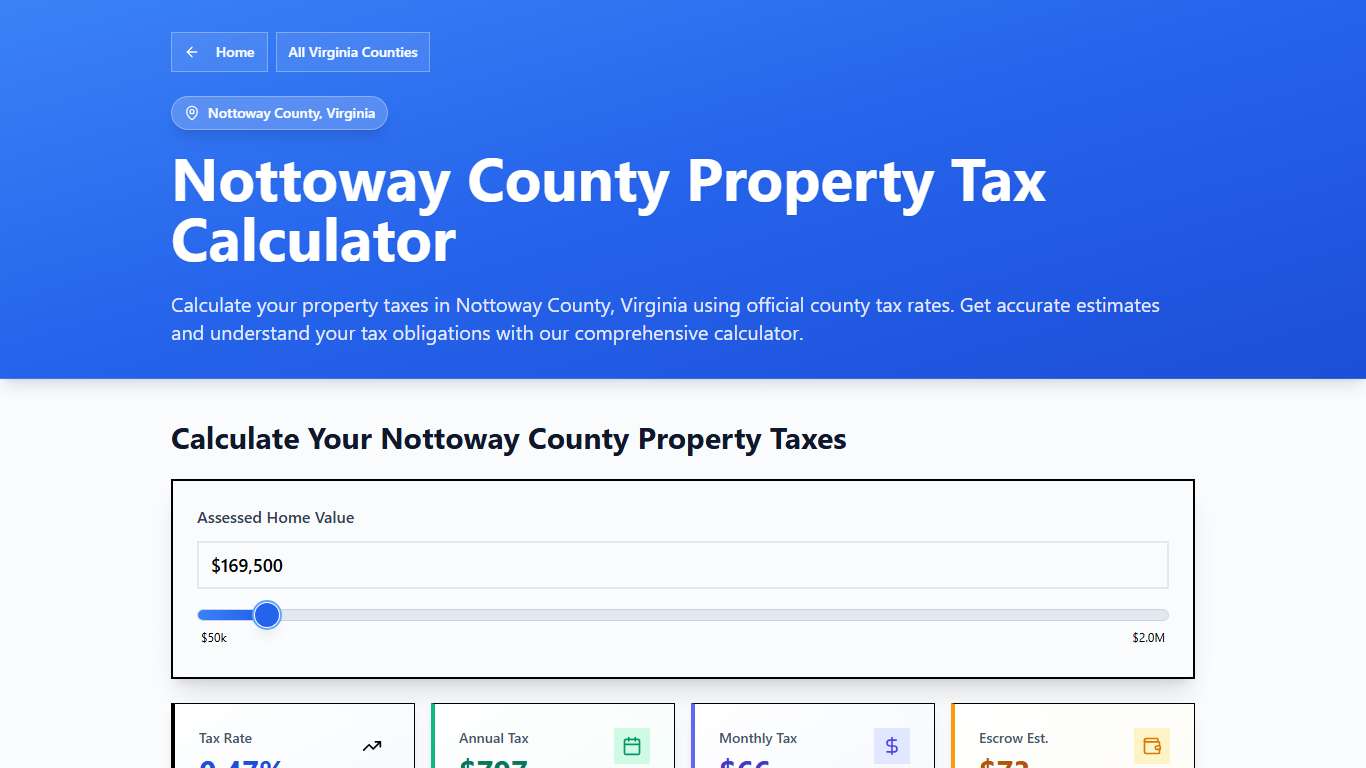

Nottoway County, VA Property Tax Calculator 2025-2026

Calculate Your Nottoway County Property Taxes Nottoway County Tax Information How are Property Taxes Calculated in Nottoway County? Property taxes in Nottoway County, Virginia are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.47% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/virginia/nottoway-county

Welcome to Nottoway County, Virginia

Geographical Information System (GIS) GIS Coordinator: Susan Tucker E-Mail: [email protected] Mailing Address: P.O. Box 92, Nottoway, VA 23955 Physical Address: 344 West Courthouse Road, Crewe, VA 23930 Telephone: 434-645-8696 Fax: 434-645-8667 GIS Maps & Data Maps and data are available online at: https://nottowaycova.interactivegis.com/login/ The GIS Department’s mission is to maintain and enhance the Nottoway County Geographic Informatio...

https://nottoway.org/departments/planning/geographical_information_system_(gis)/index.php

COUNTY TAXES ‘HURTING LOCAL ECONOMY’ - The Courier-Record

Nottoway County officials in the year ahead “have got to do something about taxes,” says District Four rep Bo Toth. “They’re already too high. It’s hurting a lot of folks, and it’s hurting the local economy, too,” Toth declared Thursday night during the Board’s monthly work session.

https://www.courier-record.com/articles/local-news/county-taxes-hurting-local-economy/

Nottovvay County

Prior Years ----- FY/2025 FY/2026. Revenue Revenue Amended Adopted. FY ... 110101-2025-001 Fire Real Estate Taxes. 250,000-. --SUB TOTAL ...

https://cms8.revize.com/revize/nottowaycountyva/FY26%20Budget%20Doc%20for%20Website.pdfNottoway County, Virginia Property Taxes - Ownwell

Nottoway County, Virginia Property Taxes Median Nottoway County effective property tax rate: 0.48%, significantly lower than the national median of 1.02%. Median Nottoway County home value: $73,900. Median annual Nottoway County tax bill: $352, $2,048 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/virginia/nottoway-county

Virginia Property Tax Calculator - SmartAsset

Overview of Virginia Taxes With an average effective property tax rate of 0.76%, Virginia property taxes come in well below the national average of 0.90%. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments.

https://smartasset.com/taxes/virginia-property-tax-calculator

Following weeks... - Arlington County Virginia – Government Facebook

Following weeks of public feedback and work sessions, the County Board adopted the Fiscal Year 2026 budget for the period that begins July 1, 2025. The Board voted to keep the real estate property tax rate at $1.033 per $100 of assessed value and to increase the meals tax rate from 4% to 5%. The Board also directed the manager to add $11 million to the County’s Economic Stabilization Reserve.

https://www.facebook.com/ArlingtonVA/posts/following-weeks-of-public-feedback-and-work-sessions-the-county-board-adopted-th/1140792964743829/

Following weeks... - Arlington County Virginia – Government Facebook

Following weeks of public feedback and work sessions, the County Board adopted the Fiscal Year 2026 budget for the period that begins July 1, 2025. The Board voted to keep the real estate property tax rate at $1.033 per $100 of assessed value and to increase the meals tax rate from 4% to 5%. The Board also directed the manager to add $11 million to the County’s Economic Stabilization Reserve.

https://www.facebook.com/ArlingtonVA/posts/following-weeks-of-public-feedback-and-work-sessions-the-county-board-adopted-th/1140792964743829/

Search Nottoway County Public Property Records Online CourthouseDirect.com

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

https://www.courthousedirect.com/PropertySearch/Virginia/Nottoway

Tax Maps and Real Estate Assessments - Brunswick County, VA

Tax maps and real estate assessments may be obtained in the Commissioner of the Revenue's Office located at 228 N Main St, Lawrenceville, VA 23868. You may also search the online GIS map.

https://brunswickco.com/how_do_i/obtain/tax_maps_and_real_estate_assessments

TAX HIKES TWO YEARS IN A ROW - The Courier-Record

NEW LEVIES PROPOSED FOR EMS & FIRE Nottoway County land owners would see a 22% increase in their taxes, and those who own vehicles would see a 27% hike if the County’s proposed budget is apdopted as advertised in today’s Courier-Record (page 11) and Crewe-Burkeville Journal.

https://www.courier-record.com/articles/featured-stories/tax-hikes-two-years-in-a-row/